Retirement

planning

It is critical that you create a comfortable and secure post-work life via planning your retirement funding through pensions, annuities, ISAs and more.

This involves setting clear goals, estimating retirement expenses and determining the sources of your income. We can guide you through your choices based on your circumstances and retirement plans, advising on accumulating wealth for retirement and helping you to preserve that wealth such that it should serve its purpose as an appropriate means for generating a sustainable retirement “income”.

- Funding: Flexible Drawdown, Annuity Purchase, Phased Retirement. Your options explained

- Cash Flow Modelling: Retirement mapping to ensure retirement objectives are affordable.

- Sustainable Income Strategies: Make sure your money never runs out.

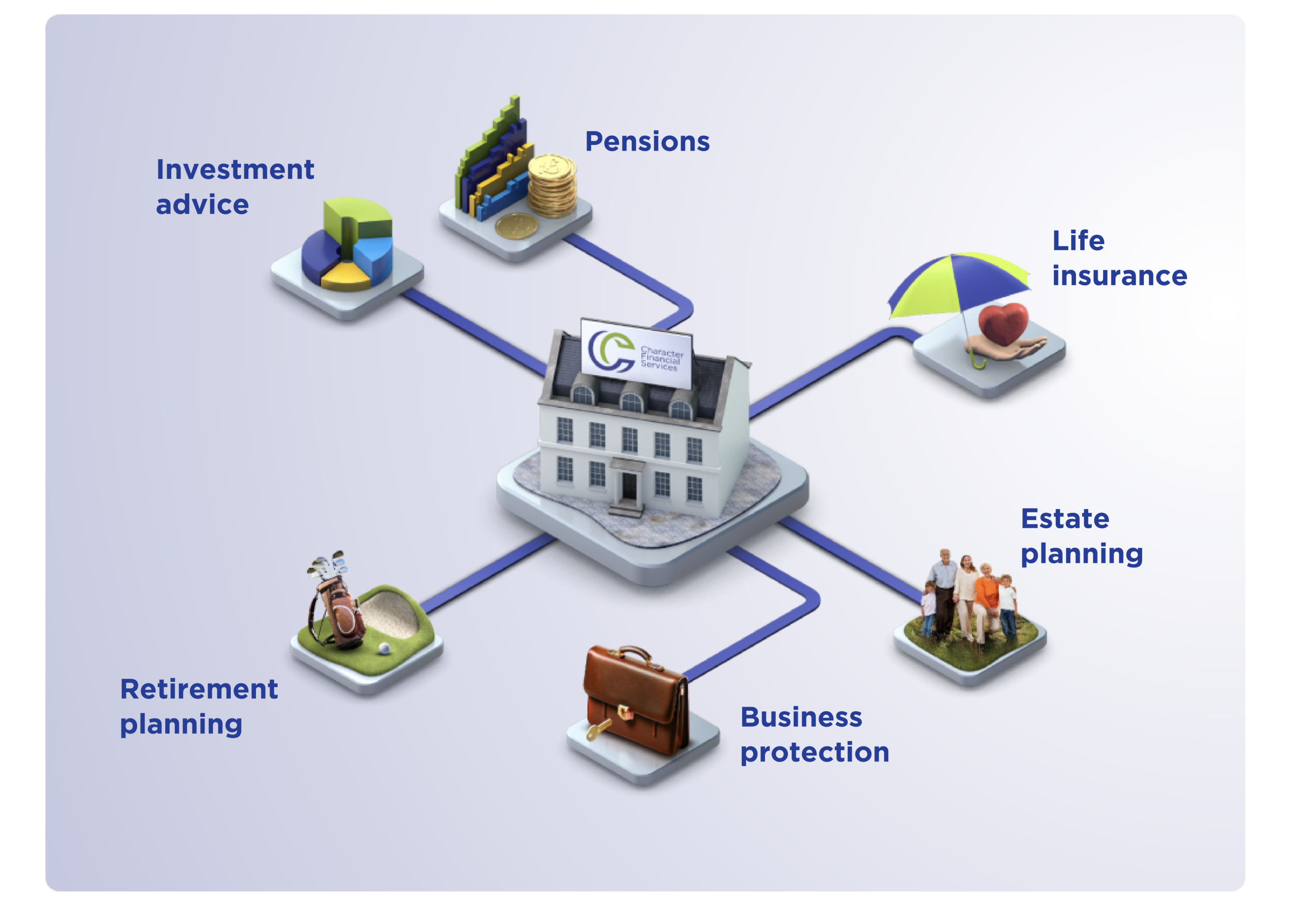

Our services

Pensions

We will work with you closely, with the sole aim of helping you keep more of your money.

Estate planning

Prevent disputes and burdens, ensuring that liability to tax does not arise unnecessarily.

Business protection

Business protection to help you stay resilient even in the face of unforeseen challenges.

Paul at Character Financial Services is amazing. He takes time to get to know you and your retirement dreams and aspirations and how he can maximise your return on investment.