Business

protection

Without adequate protection, a company can spiral into severe financial problems or even insolvency if a key shareholder, director, partner or employee dies or has to leave due to health reasons.

Business protection insurance offers a tax-free lump sum payout to handle such loss. In short, protection insurance provides liquidity and stability at the most crucial times. It ensures business continuity despite loss of shareholding directors, indispensable partners or key employees.

- Partnership / Shareholder Protection:

Provide requisite funds to purchase shares on death, protecting both the business and beneficiaries. - Key Person Protection:

Cover for irreplaceable individuals. - Private Medical Insurance:

Health cover for employees. - Relevant Life:

Tax efficient death in service cover for company directors.

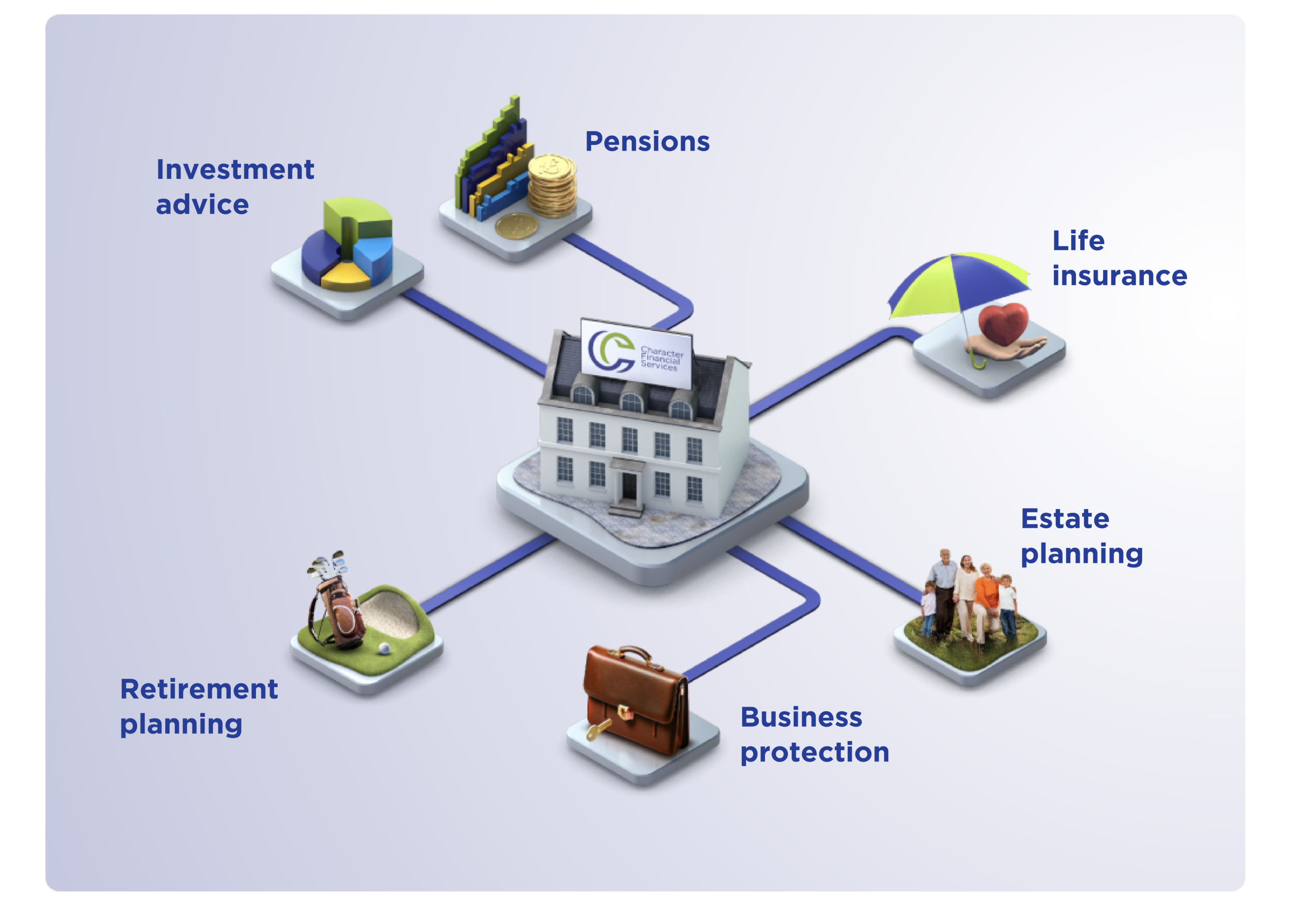

Our services

Pensions

We will work with you closely, with the sole aim of helping you keep more of your money.

Estate planning

Prevent disputes and burdens, ensuring that liability to tax does not arise unnecessarily.

Business protection

Business protection to help you stay resilient even in the face of unforeseen challenges.

I recently used Paul for my business and I must say the experience was enlightening. Paul was incredibly knowledgeable and took time to understand my financial situation and provided tailored advice that aligned with my long term objectives.